“Every person shall have the right to live in physical and spiritual prosperity, to have a home , and to receive a well and healthy environment ……”

-Article 28H Paragraph 1 of the 1945 Consitution-

The right to shelter or the right to housing is a privilege that is unrestrained by any legal system nor social culture. It is not a privilege that is granted upon a man by the State but something that is due to him by reason of his birth. It’s a mean for every individual to shelter themselves from various climate and weather changes whether from the downpour of rainfall to the scorhing heat of the sun. According to Karel Vasak, shelter is to be considered as a second generation of human rights that are complementary to the first generation of human rights, which in actualization is considered to be inseparable as a whole and is highly prioritized. It gives a sense of reflection on the basic needs of an individual and truly without it one can’t fulfill his deceny as a human being. Just as every person needs food and clothing to sustain his life, the need for shelter is also a basic need. This concept applies universally throughout the world and yet there are arising problems in Indonesia whereas tax regulation are either preventing these rights or depriving existing rights which is generally called the land value tax. But in regards to the topic, it is important to view the entirety of it’s conception to its current day form.

Land value tax in its earliest form was considered as to be the tribute system found in many early kingdoms. Particulary in Indonesia, the tribute system was already implemented by its native empires. It then changed in the colonial period, the British brought forth a type of land tax called Land Rent, then in the Dutch colonial period (1816) the Land Rent collection was retained by changing its name to Landrente and the tariff was also changed to 20% of agricultural production. Furthermore, during the Japanese government in Indonesia (1942-1945), the name Land Rent or Landrente changed to Land Tax. In these varied colonial periods came different terminologies and percentages on tariff but still had the same fundamentality and that is to oppress the natives and bring the welfare to the colonist. After the proclamation of Indonesia’s independence in 1945, the name Land Tax is called the Earth Tax. The underlying issue came at 1959 where Indonesia in that time period of time was stabilizing its government and in addition was tackling internal and external restless political disputes and therefore wasn’t able to procure a comprehensive tax system that could accomodate the citizen’s needs. As the result, Interim Government Regulation No. 11 of 1959 was issued, which was a smelting of Dutch ordinance in national law which then with the Act No. 1 of 1961 has been established into Law. Even tough there regulation was to accomodate the welfare of the people, here it is seen that there is a significant shift of colonial interest that contradicts the free and independent nature Indonesia has already achieved. This momentous change would be felt till today which now resides in Law No. 28 of 2009 on Local Taxes and Retributions , which will onward be simplified as UU PDRD.

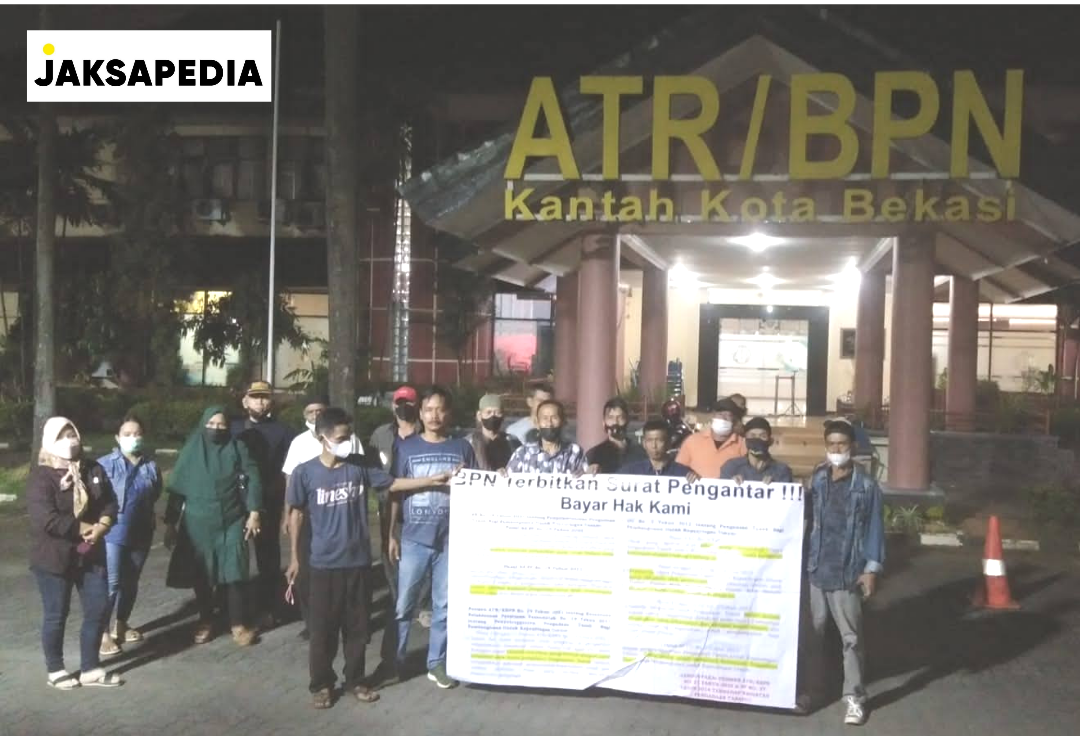

By levying annually and the rising influctuation of tariffs of the taxes on shelter (home), the implementation of UU PDRD is driving out the citizenry of Indonesia out of their homes. It applies to everyone without accounting the economic, geographical, and sociological factors of the citizens. The elderly and heirs of homes are forced to pay these tariffs regardless of their economic capabilities, and as for the means that the State provides are currently subjective and short-sighted (see Article 103 of UU PDRD) and as a result the brought forth the obligation of the current tax to arrears. This payment arrears are a phenomenon of icebergs. It occurs in many rural and urban across Indonesia. There are so many cases of non-payment / arrears that show the existence of an anomaly in the current regulation, when so many individuals violate the taxation system not because they refused to pay but rather have no capability in paying. Coupled with an increase in land prices that tend to increase every year the elderly and less fortunate to release (sell) their house and to move to more cheap and rural area, it is heart-wrenching to see when people have to release their homes, the homes they obtained with their blood, sweat, and tears, to be eventually sold to fill their obligations as “exemplary” citizen. At its current state, land value tax is comparable to a system where an individual rents a piece of land that by any legal means/status is justifiably owned by that sole individual.

As it is now UU PDRD is still an opposition to the rights to housing; it is the root of legal substances that gives power to the State to levy taxes on housing that is based on flawed concept/fundamental. From a philosophical standpoint, UU PDRD states that “Subject of the Land Value Tax in Rural and Urban Areas are the individuals or bodies that have in actuality have rights to the earth and / or benefits from the earth, and / or own, control, and / or benefit upon the building”, while I agree that beneficial/profitable activities are mandatory for taxation, but for shelter? It is an erroneous point of view! It is phrase that not only brings forth the meaning of giving the minimal benefit for the protection of climate change and weather but added and defined by the other regulations as a means of fostering the family, a reflection of the dignity of its inhabitants is improperly taxed, because this residence does not provide any economic benefits as long as the object is not sold / rented, excluding the sole the purpose of its existence—as shelter. In addition, shelter (home) differs from other objects that are taxed, it has no substitution. Taking a few examples are restaurant and vehicle retributions, these objects have substitutes and individuals could take initiative alternatives i.e. taking a public transportation and cooking by themselves. Shelters don’t have alternatives, one can’t simply fulfill a decency of a home to living in the wilderness. Then juridically, the UU PDRD in regards to rights to housing is at a disposition or is against the will of the Constitution of 1945. Where the Constitution states that every individual has the right to housing and the aforementioned taxation system is taking and/or preventing these rights, and as mentioned at the second paragraph this system is of colonial heritage and should be revised to accommodate the needs of the people.

Regarding to the problem, the State could relief every individual’s first home from land value taxes but at the end of the day ideas and practices are often two different things. There were a few attempts on reforming or abolishing the land value tax. There was the former Minister of Agriculture and Spatial / Head of National Land Agency, Fery Mursyidan Baldan with his attempt to abolish land value tax for non-commercial buildings (homes/shelters)( see http://www.tribunnews.com/bisnis/2015/02/03/alasan-pemerintah hapuskan-pbb) which bore no fruit, and specifically in Jakarta the former governor Basuki Tjahaja Purnama brought forth abolishment to land value taxes to house that values under 1 and 2 billion of Rupiah and was speculated to abolish land value tax in a progressive manner. He was discussing the matter with people such as Try Sutrisno and Meutia Hatta in the SPPT PBB-P2 event. ( see https://news.detik.com/berita/d-3437295/ahok-bertemu-try-sutrisno-dan-meutia-hatta-di-acara-sppt-pbb-p2 )

In conclusion, regarding to acknowledging the question aired in the title of this article, “Are Land Value taxes Violating Basic Human Rights?” Yes, based on the arguments that were mentioned above, but it is far from a simple conclusion, it is a complex and intricate problem yet very people have noticed and fewer who are willing to tackle this legal problem and those who tried has yet yield significant changes. Currently a philosophical mindset looms above the populace that inherently approves the current legal taxation system because they believe that “the law is valid because the law say it is”. This is a issue needs that needs to be properly and hastily addressed , and disregarding it any further might bring greater repercussions felt not only at the current but also for the days to come.